Your Primer for What to Expect in the Budget Reconciliation Process

Let's Save Energy

Alliance to Save Energy's Blog

Feel like you have “budget reconciliation” fatigue while trying to track the fate of energy efficiency tax credits? You’re not alone.

This process often elicits puzzled looks. But understanding it helps you better appreciate the hurdles ahead for at-risk EE tax credits, not to mention help you flag points where advocacy is crucial.

As the White House and Congressional Republicans push to enact the domestic agenda of President Donald Trump, including extension of the $4 trillion 2017 Tax Cuts and Jobs Act (TCJA), elimination of President Joe Biden’s clean-energy-focused IRA, deep cuts to Medicaid, and increased defense and border spending, consider this as a primer on what to expect.

First, Some House and Senate Basics

Let’s begin with a key distinction between the House and Senate.

The House of Representatives is driven by its majority and passes legislation along party lines requiring a simple majority (more than half the votes). It also shapes its own rules at each stage of the process to facilitate the Speaker of the House’s agenda.

The Senate, on the other hand, is bound by a long-standing set of rules. An important one is about debate: normally, any senator has the right to hold the floor for unlimited debate (aka, a filibuster when used as a delay tactic). It takes a supermajority of three-fifths (60 out of 100 senators) to end debate and move along (cloture). This makes passing partisan measures in the Senate difficult.

The process of budget reconciliation has slightly different rules. Congress can skip that 60-vote Senate threshold, allowing a simple majority to pass legislation so long as it impacts spending or the receipt of revenues.

Reconciliation is actually a relatively modern Congressional process—unlike many that date back to the Founding Fathers. It was spawned from the Budget Control Act of 1974 as a Congressional response to the tumultuous Nixon administration.

Congress increasingly uses reconciliation for controversial or partisan bills that would be hard to pass under normal Senate rules. Since 1980, Congress has initiated reconciliation 28 times, with 23 bills signed into law, including the Inflation Reduction Act (IRA) of 2021, which is largely the target of the current effort, H.R. 1, the Big, Beautiful Bill.

This should make everything pretty cut-and-dry, right? Not quite.

One Byrd to Rule Them All

Enter the Senate’s Byrd Rule, designed in 1985 by late Senator Robert Byrd (D-W.Va.).

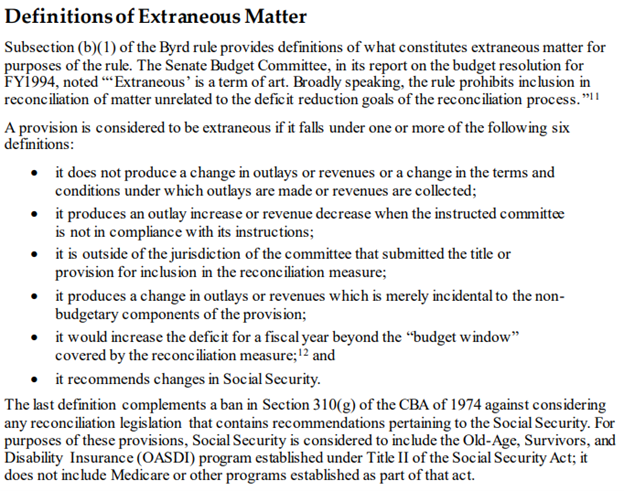

The Byrd Rule limits the privilege of using the reconciliation process. It says that only things that directly affect government spending or taxes can be included. Any unrelated ideas or detailed policy changes—like explaining exactly how a law will work or who it applies to—are typically considered “extraneous” and must be left out. There are six aspects to consider when determining whether a measure is extraneous (see Photo 1).

Photo 1. Definitions of Extraneous Matter (Source: CRS)

Key to what’s going on now: The House bill that passed May 21 contains many policy provisions that go beyond spending or receipt of funds, that may very well be ruled out-of-order, in the process of reviewing all measures, dubbed the “Byrd Bath.”

Once the House measures are repackaged with the Senate’s own provisions in a comprehensive bill and scrubbed through the Byrd Bath, the Senate will have a time-limited 20 hours to debate the bill as presented. It then will proceed to vote on an unlimited number of individual amendments or “points or order,” mostly submitted by the opposition party in an attempt to strike the extraneous provisions or improve disagreeable text (aka, a “Vote-a-Rama”).

Parliamentary Politics

The Senate Parliamentarian (whose job is to interpret rules and procedures of the Senate) is tasked with deciding whether provisions are in-order. However, the Majority Leader can call a vote to override the parliamentarian and has the official capacity to remove them from their position.

This is a key point for the current bill. Senate Budget Committee leader Sen. Lindsey Graham (R-S.C.), in a somewhat risky technical maneuver, ruled that continuing certain tax cuts won’t count as costing the government any money. He claims those tax cuts are already part of the current tax rules, also called the “existing baseline.” This decision is controversial because it goes against normal budget math, potentially raising red flags with the Senate parliamentarian.

If the parliamentarian rules the baseline to be in error, or rules key provisions of the House reconciliation package to be extraneous, Majority Leader John Thune (R-S.D.) can call a vote to override their views, but these votes require 60 to pass.

X-Date and X-Factors

Timing challenges are driving the Senate to meet its target July 4 passage of the bill.

House leadership added a $5 trillion extension of the debt ceiling to the reconciliation package. That means that the reconciliation effort has to be wrapped up by August, the so-called X Date when the U.S. government defaults on its $36 trillion debt.

The fiscal year ends shortly thereafter on September 30. If the August X-Date deadline is missed, the FY25 budget resolution could die on the vine. Another resolution for FY26 could be passed, but TCJA tax levels stand to expire.

Historically, time is not on Congress’ side. According to the Congressional Research Service, reconciliation efforts range from 28 to 385 days from adoption to passage, with an average of 152 days. The House took 86 days to send the Big, Beautiful Bill to the Senate, which left 131 days to the end of FY25.

The Upshot

With this roadmap in mind, where does the budget bill stand—and with it the fate of key energy efficiency tax credits?

Even if the Senate parliamentarian says parts of the bill don’t follow the rules, the Senate Majority Leader can choose to ignore that advice. Because the Vice President can cast a tie-breaking vote, Senate leadership holds significant control.

But even with that power, passing the bill won’t be easy.

The Republican senators aren’t all on the same page. Some moderates, like Senators Lisa Murkowski (R-Alaska) and Thom Tillis, (R-N.C.) are at odds with House provisions that would eliminate certain energy tax credits. They even sent a letter to Senate Leader Thune in support of them.

Murkowski (an ASE Honorary Advisor) later expressed support for the Sec. 25C Energy Efficient Home Improvement Credit, which along with the 45L Energy Efficient New Home Credit, are axed in H.R. 1.

On the other hand, more conservative Republicans want to remove clean energy programs completely. Because Republicans have 53 Senate seats, leaders have to carefully balance both sides of the party—keeping moderates happy while not losing support from hardliners.

And even if the Senate agrees on a version of the bill, they’ll still have to negotiate again with the House to work out the differences.

TIMELINE OF 2025 BUDGET RECONCILIATION

Stage 1: Budget Resolution adopted by each chamber (including Reconciliation directives/instructions)

- February 21: Senate adopts S.Con.Res. 7, a budget resolution for FY2025. No further action on S.Con.Res. 7.

- February 25: House adopts H.Con.Res. 14, and proceeds to Committee action.

Stage 2: Committees develop and report legislative language

- Committees comply with Reconciliation instructions

- Omnibus legislation prepared by Budget Committee (and reported or rejected and amended)

- House Budget vote #1 (May 16): House Budget Committee rejects

- House Budget vote #2 (May 20): House Budget Committee reports (H.Rept. 119-106)

- House Rules vote on H.R. 1, as modified (differences)

- Senate, no action

Stage 3: Floor consideration

- House – May 21: House Adopts H.R. 1, 215-214 (Roll Call Vote No. 145)

- Senate: Will begin Stage 2 in June, Floor action (vote-a-rama) expected by X Date (August)

Stage 4: Resolving differences (Conference), TBD

Stage 5: Final action: Signed by President

Stay connected to the policies driving the energy efficiency dialogue on Capitol Hill this summer by registering free for the Alliance to Save Energy's Virtual Summer Policy Series 2025.

RECENT BLOG POSTS

STAY EMPOWERED

Help the Alliance advocate for policies to use energy more efficiently – supporting job creation, reduced emissions, and lower costs. Contact your member of Congress.

Energy efficiency is smart, nonpartisan, and practical. So are we. Our strength comes from an unparalleled group of Alliance Associates working collaboratively under the Alliance umbrella to pave the way for energy efficiency gains.

The power of efficiency is in your hands. Supporting the Alliance means supporting a vision for using energy more productively to achieve economic growth, a cleaner environment, and greater energy security, affordability, and reliability.